52 week savings challenge pdf free

The 52-Week Savings Challenge⁚ A Comprehensive Guide

The 52-week savings challenge is a popular method for building savings over time. A 52-week money challenge PDF provides a structured savings plan for setting aside money each week. Saving progressively larger amounts builds savings for important goals. The pdf outlines the weekly targets for saving over the year-long challenge. The document lists savings amounts beginning with 1 the first week progressing up to saving 52 in week 52. The 52-week money challenge is a simple and effective way to stay on track. And at the end of the year, you’ll have 1,378 extra dollars to bulk up your emergency savings or put toward a savings goal, such as a vacation fund or a down payment on a home.

What is the 52-Week Savings Challenge?

The 52-Week Savings Challenge is a popular personal finance challenge that encourages individuals to save a specific amount of money each week for a year. This method involves gradually increasing the amount saved each week, culminating in a substantial sum by the end of the year. The challenge is designed to foster a consistent savings habit and provide a structured approach to building a significant emergency fund or reaching a specific financial goal. The 52-week savings challenge is a simple and effective way to stay on track. And at the end of the year, you’ll have 1,378 extra dollars to bulk up your emergency savings or put toward a savings goal, such as a vacation fund or a down payment on a home.

The 52-week savings challenge PDF is a downloadable document that provides a structured plan for the challenge. It outlines the weekly savings amounts, often starting with $1 in the first week and increasing by $1 each subsequent week. This format allows users to track their progress and visualize the cumulative savings over the year. The 52-week savings challenge is a popular method for building savings over time. A 52-week money challenge PDF provides a structured savings plan for setting aside money each week. Saving progressively larger amounts builds savings for important goals. The pdf outlines the weekly targets for saving over the year-long challenge. The document lists savings amounts beginning with 1 the first week progressing up to saving 52 in week 52.

The 52-week savings challenge PDF can be a valuable tool for anyone looking to build a savings habit and achieve their financial goals. It provides a clear and straightforward roadmap, making it easy to track progress and stay motivated. By following the guidelines outlined in the PDF, individuals can develop a consistent savings plan that can significantly enhance their financial well-being.

How the 52-Week Savings Challenge Works

The 52-Week Savings Challenge is a straightforward yet effective approach to building savings. It involves saving a progressively increasing amount of money each week for 52 weeks, culminating in a significant sum at the end of the year. The concept is based on gradually increasing the amount saved each week, starting with a small sum and incrementally increasing it until the final week. This method encourages a steady build-up of savings, making it easier to achieve a substantial financial goal.

The traditional 52-Week Savings Challenge follows a simple pattern⁚ in week one, you save $1; in week two, you save $2; in week three, you save $3, and so on. By the end of week 52, you will have saved a total of $1,378. This incremental approach allows individuals to gradually adjust to saving more money each week, making it a less overwhelming process. The 52-week savings challenge is a popular method for building savings over time. A 52-week money challenge PDF provides a structured savings plan for setting aside money each week. Saving progressively larger amounts builds savings for important goals. The pdf outlines the weekly targets for saving over the year-long challenge. The document lists savings amounts beginning with 1 the first week progressing up to saving 52 in week 52.

The 52-Week Savings Challenge PDF can be a valuable resource for those embarking on this savings journey. These downloadable documents often include a table or chart that outlines the weekly savings amounts for the entire year. They can also provide additional tips and strategies for success, such as setting a specific financial goal, choosing a dedicated savings account, and tracking progress regularly. The 52-week savings challenge is a simple and effective way to stay on track. And at the end of the year, you’ll have 1,378 extra dollars to bulk up your emergency savings or put toward a savings goal, such as a vacation fund or a down payment on a home.

Benefits of the 52-Week Savings Challenge

The 52-Week Savings Challenge offers a range of benefits for individuals seeking to cultivate a savings habit and achieve their financial goals; Its structured approach and achievable increments make it a compelling option for those who may find traditional savings methods daunting. Here are some of the key advantages of embracing this challenge⁚

Habit Formation⁚ The 52-Week Savings Challenge effectively encourages the development of a consistent savings habit. The weekly increments, starting small and gradually increasing, create a sense of routine and make saving a regular part of your financial management. This can lead to a long-term shift in your spending and saving patterns, fostering a more disciplined approach to personal finances. The 52-week savings challenge is a simple and effective way to stay on track. And at the end of the year, you’ll have 1,378 extra dollars to bulk up your emergency savings or put toward a savings goal, such as a vacation fund or a down payment on a home.

Goal-Oriented Savings⁚ By setting a specific savings target at the outset, the 52-Week Savings Challenge provides a clear path toward achieving a financial goal. This goal-oriented approach can be highly motivating, as you can visualize the tangible benefits of your consistent savings effort. Whether it’s a down payment on a house, a dream vacation, or simply building an emergency fund, the challenge offers a structured framework for achieving your financial aspirations. The 52-week savings challenge is a simple and effective way to stay on track. And at the end of the year, you’ll have 1,378 extra dollars to bulk up your emergency savings or put toward a savings goal, such as a vacation fund or a down payment on a home.

Psychological Impact⁚ The 52-Week Savings Challenge can have a positive psychological impact by fostering a sense of accomplishment and control over your finances. As you progress through the challenge and see your savings accumulate, you experience a sense of satisfaction and empowerment. This positive reinforcement can further strengthen your commitment to saving and encourage you to pursue other financial goals. The 52-week savings challenge is a simple and effective way to stay on track. And at the end of the year, you’ll have 1,378 extra dollars to bulk up your emergency savings or put toward a savings goal, such as a vacation fund or a down payment on a home.

Variations of the 52-Week Savings Challenge

The 52-Week Savings Challenge, in its traditional form, involves saving an increasing amount each week, culminating in a total of $1,378 by the end of the year. However, the core concept of this challenge has spawned various adaptations and variations, catering to different financial goals and preferences. These variations offer flexibility and allow individuals to tailor the challenge to their specific needs.

Fixed-Sum Variation⁚ Instead of progressively increasing weekly savings, the fixed-sum variation involves saving the same amount each week. This can be particularly appealing for those who prefer a consistent saving approach and find the escalating increments of the traditional challenge less manageable. For example, you could choose to save $26.50 each week for 52 weeks, resulting in the same total savings of $1,378. The fixed-sum approach can provide a more predictable and stable savings plan, especially for those with tight budgets.

Reverse Challenge⁚ The reverse challenge flips the traditional saving pattern, starting with the highest amount and gradually decreasing each week. This variation can be appealing for those who prefer to save a larger sum initially and then ease into smaller weekly contributions. The reverse challenge can be a good option for those who anticipate having more disposable income at the beginning of the year and want to maximize their savings early on.

Personalized Goals⁚ The 52-Week Savings Challenge can be adapted to accommodate personalized savings goals. Instead of targeting $1,378, you can adjust the initial amount and weekly increments to match your desired savings target. For instance, if you want to save $5,000 in a year, you could start by saving $4 in the first week, $8 in the second week, $12 in the third week, and so on. This allows you to tailor the challenge to your specific financial aspirations and make it more relevant to your individual circumstances.

52-Week Savings Challenge⁚ Incremental vs. Fixed Sum

The 52-Week Savings Challenge offers two primary approaches to saving⁚ the incremental method and the fixed-sum method. Each approach has its own advantages and disadvantages, appealing to different saving styles and financial situations. Understanding the nuances of each method can help you choose the one that aligns best with your goals and preferences.

The incremental method, often referred to as the traditional approach, involves increasing the amount saved each week. This method typically starts with saving $1 in the first week, $2 in the second week, and so on, escalating until you save $52 in the final week. The incremental method provides a visual representation of progress as the weekly savings amount grows, motivating you to stick to the challenge. It also allows you to gradually increase your savings commitment, making it easier to adjust to higher savings amounts over time. However, the escalating increments can be challenging for those with tight budgets or who prefer a more predictable savings pattern.

The fixed-sum method, on the other hand, involves saving the same amount every week for 52 weeks. This approach offers a consistent and predictable savings plan, making it easier to budget and track your progress. It can be particularly appealing for those who find the escalating increments of the traditional method daunting or who prefer a more stable savings approach. For instance, you could choose to save $26.50 every week for 52 weeks, resulting in the same total savings of $1,378. The fixed-sum method provides a sense of control and predictability, which can be beneficial for individuals who value consistency and stability in their finances.

Ultimately, the choice between the incremental and fixed-sum method depends on your personal saving style and financial goals. If you prefer a visual representation of progress and are comfortable with gradually increasing your savings commitment, the incremental method might be a good fit. If you value consistency, predictability, and a stable savings plan, the fixed-sum method could be a better choice.

Tips for Success with the 52-Week Savings Challenge

The 52-Week Savings Challenge can be a powerful tool for building your savings, but it requires discipline and consistency. To ensure your success, consider these valuable tips⁚

- Set a Clear Goal⁚ Define a specific financial objective for your savings. Whether it’s a down payment on a house, a dream vacation, or building an emergency fund, having a clear goal will provide motivation and help you stay focused.

- Choose the Right Approach⁚ Decide whether the incremental or fixed-sum method aligns better with your saving style and financial situation. Remember, the incremental method gradually increases savings, while the fixed-sum method maintains a consistent weekly amount.

- Track Your Progress⁚ Use a printable 52-week savings challenge chart to monitor your savings journey. This visual representation will help you visualize your progress, stay motivated, and identify areas for improvement.

- Automate Your Savings⁚ Set up automatic transfers from your checking account to your savings account each week. This will ensure that you consistently save, even when you forget or are tempted to spend the money.

- Find Extra Income⁚ Explore ways to increase your income to support your savings goals. Consider taking on a side hustle, selling unwanted items, or requesting a raise at work.

- Reduce Expenses⁚ Analyze your spending habits and identify areas where you can cut back. Look for ways to save money on groceries, entertainment, transportation, and other expenses.

- Make it Fun⁚ Turn saving into a game by rewarding yourself for reaching milestones. Celebrate your progress and acknowledge your commitment to financial well-being.

- Stay Accountable⁚ Share your savings goals with friends, family, or a financial advisor. Having someone to hold you accountable can increase your motivation and commitment to the challenge.

Remember, consistency is key to achieving your savings goals. By implementing these tips and staying disciplined, you can successfully complete the 52-Week Savings Challenge and reap the benefits of your financial discipline.

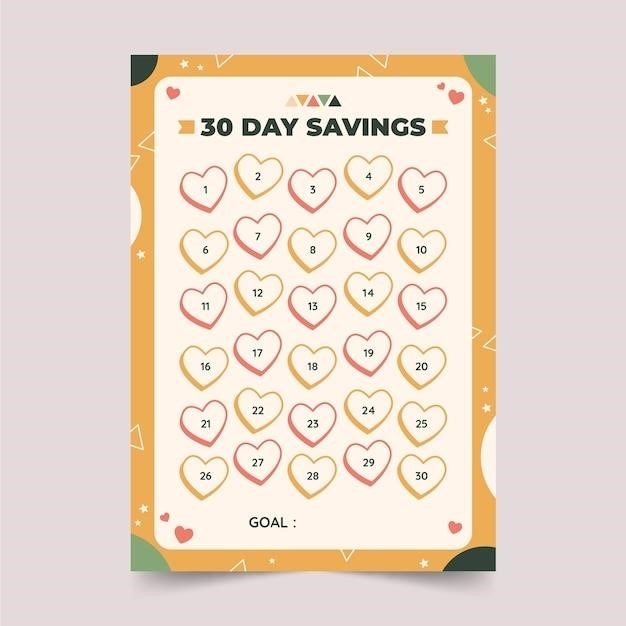

Free Printable 52-Week Savings Challenge Charts

A crucial element of the 52-Week Savings Challenge is tracking your progress. Free printable 52-week savings challenge charts are readily available online, providing a visual representation of your saving journey and helping you stay motivated. These charts often feature a grid or calendar format, allowing you to mark off each week as you reach your savings goal. The charts can be customized to reflect your personal preferences, such as the amount you wish to save each week, your desired savings goal, and even a motivational quote or image.

Utilizing a printable chart offers several advantages⁚

- Visual Motivation⁚ The chart provides a clear visual representation of your progress, showing you how much you’ve saved and how much further you need to go. This visual reminder can be highly motivating, particularly when you see your savings steadily increasing.

- Accountability⁚ The chart serves as a visual reminder of your commitment to the challenge. Seeing the empty squares or unchecked boxes can encourage you to stay on track and resist temptation.

- Flexibility⁚ Printable charts are customizable, allowing you to adjust the savings amounts, goals, and design to fit your specific needs and preferences.

- Accessibility⁚ Free printable charts are readily available online, making them easily accessible to anyone who wants to participate in the 52-Week Savings Challenge.

When choosing a printable chart, select one that aligns with your saving style and goals. Remember, the chart is a tool to help you stay motivated and accountable. Take advantage of these free resources to make the 52-Week Savings Challenge a successful and rewarding experience.